Calculate net present value online

To calculate the NPV we simply sum up these values. In the third year the company expects 150000 and the profits keep growing in increments of 50000.

How To Use The Excel Npv Function Exceljet

NPV 722169 - 250000 or 472169.

. Where F_t F t. Register free for online tutoring session to clear your doubts. However if the net.

Using the NPV formula the anticipated profit of the investment will be around 319754. Lets calculate the NPV and also evaluate whether the company should pursue this decision or not. The NPV calculator considers the expenses revenue and capital costs to determine the worth of an investment or project.

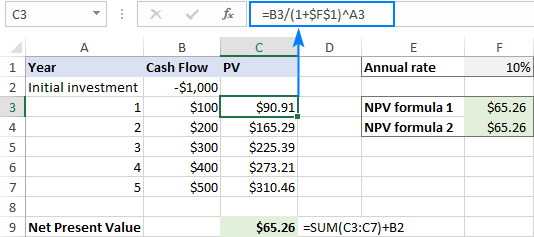

If each period generates returns in equal amounts the formula for the net present value of a project is. The net present value NPV N P V can be computed using the following formula. Net Present Value -1 Initial Investment Cash1 1 Rate Cash2 1 Rate 2 Cash3 1 Rate 3.

The equation we have. If the net present value is positive for a project that means that we should invest. NPV displaystyle sum_ t0n frac F_t 1it N P V t0n 1itF t.

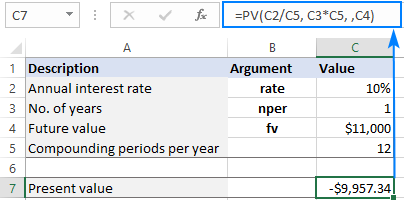

The present value formula is used to determine what amount of money you would need to invest today in order to have a certain amount in the future allowing for different interest rates and. It is possible to use the calculator to learn this concept. How do you calculate the net present value of a project.

In the second year the company expects to produce 100000 in profit. The formula would look like this. We can ignore PMT for simplicitys sake.

NPV C x 1 1 R -T R. Initial Investment 1000 10000000 Discount Rate. NPV Calculator - Net Present Value NPV Calculator Know Formula Benefits NPV Calculator Get a quick estimate on your NPV returns.

Net Present Value Formula. Home financial present value calculator Present Value Calculator This present value calculator can be used to calculate the present value of a certain amount of money in the future or. NPV C 1 1r C 2 1r 2 C 3 1r 3 C 4 1r 4 C 5.

It is important to note that the net present value is a part of the. The basic idea is to create value by identifying an investment worth more in the marketplace than it initially cost us to acquire. 50000 x 1- 11x-12 1 - 243000.

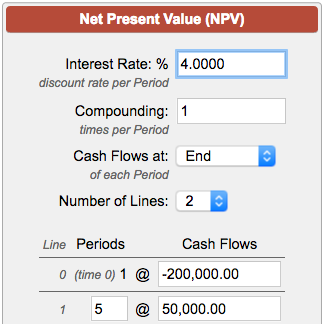

Use this online calculator to easily calculate the NPV Net Present Value of an investment based on the initial investment discount rate and investment term. This computed value matches. It helps in determining if it is worth pursuing an investment.

Pressing calculate will result in an FV of 1060. Net Present Value Definition. And this gives me 32561.

Input 10 PV at 6 IY for 1 year N. Net Present Value NPV Calculator for a Constant Discount Rate Calculate the Net Present Value of an Investment Using a Fixed Discount Rate Input Fields Number of Periods Select the. In order to calculate NPV we must discount each future cash flow in order to get the present value of each cash flow and then we sum those present values associated with each time.

Then to compute the final NPV subtract the initial outlay from the value obtained by the NPV function. Also calculates Internal Rate of.

:max_bytes(150000):strip_icc():gifv()/NPV2-eb0a220d0e72459bbae81de6f237b6a0.png)

Net Present Value Npv What It Means And Steps To Calculate It

Formula For Calculating Net Present Value Npv In Excel

/NPV2-eb0a220d0e72459bbae81de6f237b6a0.png)

Net Present Value Npv What It Means And Steps To Calculate It

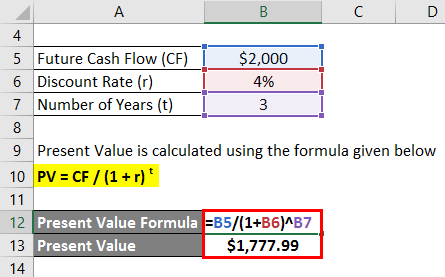

Present Value Formula Calculator Examples With Excel Template

Present Value Formula And Pv Calculator In Excel

:max_bytes(150000):strip_icc()/NPVFormula-5c23ea8f46e0fb00013d2624.jpg)

Net Present Value Vs Internal Rate Of Return

How To Calculate Net Present Value Npv In Excel Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv What It Means And Steps To Calculate It

Npv Calculator Calculate Net Present Value

Net Present Value Calculator

Formula For Calculating Net Present Value Npv In Excel

Present Value Of An Annuity How To Calculate Examples

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Calculate Npv In Excel Net Present Value Formula

Calculate Npv In Excel Net Present Value Formula

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Calculate Npv In Excel Net Present Value Formula